Introduction

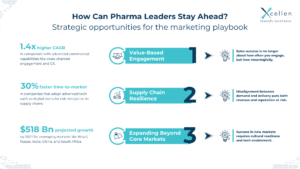

As discussed in Part I, traditional sales models are giving way to more nuanced, data-driven strategies that prioritize meaningful engagement over sheer volume. The shift toward value-based selling, supply chain integration, and market expansion is already reshaping how sales teams operate.

However, identifying these trends is only half the battle. The real challenge lies in how companies can implement strategies that align with these evolving dynamics while maintaining efficiency and strong customer relationships.

In this second part, we discuss how pharmaceutical companies can stay ahead, from refining sales force agility to leveraging digital transformation and expanding into underserved markets.

With the right strategies, sales teams can do more than adapt, they can thrive amidst evolving regulations, digital transformation, and shifting HCP expectations.

Recap: The Need for a Sales Force Transformation

Source: McKinsey, IBM, HBR

In Part I of this series, we explored three key trends that are already reshaping pharmaceutical sales strategies:

1. Value-Based Engagement Over Volume-Based Selling

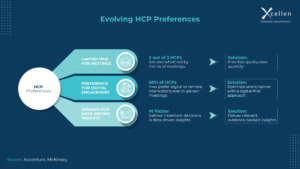

Gone are the days when frequent in-person visits drove sales. In a survey conducted by Accenture two-thirds of HCPs mentioned they feel overwhelmed by the volume of meeting invites and cannot find time for all. They also rated data-driven insights, including clinical trials and real-world evidence, as the most influential factors in their treatment decisions. Today, HCPs have less time and greater access to digital resources, making traditional rep-led selling ineffective.

Instead, pharma companies must:

- Engage HCPs with meaningful, insight-driven conversations

- Incorporate real-world evidence (RWE) and clinical trial insights

- Use omnichannel strategies to blend digital and in-person interactions

- Focus on patient outcomes rather than just product promotion

2. Aligning Commercial Excellence with Supply Chain Resilience

A great sales strategy is meaningless if the product isn’t available when and where it’s needed. The disruptions seen in recent years—whether due to global crises, logistics issues, or supply shortages—have made supply chain resilience a key driver of sales effectiveness. Pharma companies must:

- Enhance supply chain visibility to anticipate potential disruptions

- Integrate sales and supply chain functions for seamless coordination

- Develop contingency plans to maintain product availability and trust

3. Expanding Beyond Core Markets –

With regulatory pressures and market saturation slowing growth in traditional markets, pharmaceutical companies are shifting focus to emerging economies where demand for accessible healthcare solutions is rising.

These three trends have set the stage for the next phase of transformation, one that leverages technology, leadership, and strategic execution to bridge the gap between evolving market expectations and on-ground execution.

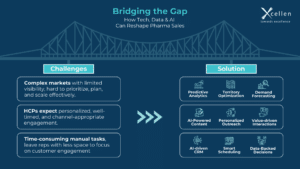

Tools and Technologies to Bridge the Gap

Technology has long been a supporting player in pharmaceutical sales, but as market complexities grow, it’s taking on a far more strategic role. The question isn’t whether to use technology, but rather how to use it effectively—not just to improve efficiency, but to align sales efforts with real business impact.

Using Data to Improve Decision-Making

For years, sales teams have relied on experience and intuition to guide their approach. While that instinct is valuable, it’s not always scalable or consistent. Today sales teams have access to an unprecedented volume of data—from prescribing patterns and patient demographics to engagement history and real-world evidence. Studies have shown that high-growth medtech companies make data-driven decisions, which give them an edge over competitors by improving sales alignment and enhancing account performance.

However, data alone is not enough; it must be leveraged effectively. AI and predictive analytics can help to identify high-value opportunities with far greater precision.

- What if territories were assigned based on real-time prescribing trends rather than outdated assumptions?

- What if reps could anticipate demand shifts instead of reacting to them?

- What if engagement strategies were shaped by data on HCP preferences rather than one-size-fits-all outreach?

With AI-driven CRM and predictive insights, these “what-ifs” are becoming standard practice.

Predictive analytics can help sales teams identify high-value HCPs, anticipate prescribing behaviors, and tailor engagement strategies accordingly.

Real-time dashboards enable field representatives to make informed decisions on the go, adjusting their approach based on customer insights rather than rigid call schedules.

Micro-segmentation of HCPs using advanced analytics and data-driven targeting, creating segments such as:

- Treatment preferences: Which therapies do they favor for different patient groups?

- Digital engagement behavior: Do they prefer webinars, whitepapers, or one-on-one interactions?

- Network influence: How connected are they within the medical community, and do they influence peer prescribing?

Rethinking Engagement: Omnichannel, But With Purpose

HCPs are engaging differently than they were even five years ago, yet many sales teams are still pushing the same outreach strategies. The shift isn’t just from in-person to digital—it’s about understanding how and when HCPs prefer to engage. McKinsey reported that 60% of HCPs favor digital or remote interactions when exploring new technologies, seeking proposals, and making purchasing decisions.

Rather than defaulting to the usual touchpoints, teams can now experiment with:

- AI-driven content recommendations that deliver relevant information when HCPs are most likely to engage.

- Personalized digital and in-person interactions that adapt to the HCP’s preferences.

- More strategic rep engagements that add value rather than just repeating product messaging.

Automation: More Than Just Convenience

Time spent on admin work is time not spent engaging customers. Automating processes like data entry, reporting, and scheduling doesn’t just improve productivity, it allows sales teams to focus on higher-value interactions. Forbes recently noted that about 55% of organizations across industries have gained positive results through automation.

- What if reps spent less time figuring out where to go next and more time preparing meaningful discussions?

- What if teams had real-time visibility into engagement effectiveness instead of relying on anecdotal feedback?

Where Xpower Fits In

Technology alone doesn’t solve inefficiencies, it depends on how you use it. Xpower, Xcellen’s intelligent sales effectiveness platforms, are designed to bridge these gaps by:

Eliminating territory misalignment: so reps focus on where they’ll have the most impact.

Providing data-driven engagement insights: so every interaction has a purpose.

Bringing sales and strategy together: so execution aligns with business goals.

The shift toward data-driven, omnichannel, and automated sales processes isn’t just about keeping up—it’s about staying ahead. The companies that adapt now will be the ones defining best practices in the years to come.

Building a Resilient and Integrated Commercial Model

While pharmaceutical companies focus on enhancing engagement strategies and expanding into new markets, long-term success hinges on operational resilience. The ability to align sales force effectiveness with supply chain stability will be a defining factor in commercial success.

Aligning Sales and Supply Chain Operations

A persistent challenge in the industry is the disconnect between sales teams and supply chain operations. Integrating AI-driven demand forecasting, real-time inventory tracking, and better communication between sales and supply chain teams can ensure quicker response times and greater flexibility. By creating a more synchronized approach between commercial and logistics functions, pharmaceutical firms can prevent misalignment that could otherwise impact their reputation and revenue.

Scenario Planning and Risk Mitigation

A reactive approach is no longer sufficient; instead, companies must implement stress tests for their commercial models, regularly evaluating how they would respond to supply constraints or sudden demand surges. Diversifying supplier networks and securing alternative distribution channels can provide a buffer against uncertainties. It will not only safeguard their operations but also maintain trust with HCPs and patients who depend on product availability.

Sustainable Commercial Strategies

Healthcare institutions and regulatory bodies are increasingly favoring partners that prioritize environmental, social, and governance (ESG) standards. Pharmaceutical firms must incorporate eco-friendly distribution models, ethical sourcing, and accessible pricing strategies into their commercial framework. Companies that embed ESG principles into their commercial strategies will not only strengthen their brand credibility but also attract investors, government partnerships, and long-term customer loyalty.

The Role of Leadership: Driving Change from the Top

Technology and data can streamline sales processes, but real transformation starts with leadership. The way sales teams operate is often a reflection of the culture set at the top. If leaders want their teams to adopt a more agile, value-driven approach, they need to create an environment where adaptability, learning, and collaboration are not just encouraged, but expected.

Why a Cultural Shift is Essential

Many sales teams are structured for a past era—one where the frequency of HCP visits was the primary measure of success. However, as engagement models evolve, leadership must redefine what effective selling looks like.

- Should success still be measured in the number of visits or the quality of engagement?

- Should sales teams be expected to hit quotas, or to drive meaningful clinical conversations?

- Should strategy be set top-down, or shaped in collaboration with those who interact with customers daily?

These are the kinds of questions leaders need to ask if they want sales teams to keep up with industry shifts.

Upskilling Sales Teams for a New Era

The role of a pharma sales rep is no longer just about delivering product information—it’s about understanding patient outcomes, leveraging data, and navigating digital-first interactions. To succeed in this environment, sales teams need continuous skill development in:

- Interpreting and communicating real-world evidence to HCPs.

- Using AI-driven insights to tailor outreach strategies.

- Navigating omnichannel engagement and knowing when to use each touchpoint.

Investing in these capabilities isn’t just about making sales teams more effective—it’s about ensuring they remain relevant. Moreover, workplaces that focus on employee learning and development enjoy a competitive advantage in the marketplace.

Aligning Organizational Goals with On-Ground Execution

A common challenge in pharma sales is the gap between corporate strategy and day-to-day execution. Leaders set broad objectives, but without the right structure, those goals don’t always translate into effective field action.

- Are sales incentives aligned with value-driven engagement, or still tied to call volume?

- Is there cross-functional collaboration between sales, marketing, and medical teams, or do they still operate in silos?

- Are digital tools seen as a burden or an enabler by sales teams?

Leadership plays a crucial role in ensuring that sales teams have the right resources, incentives, and cultural mindset to execute the broader vision. Technology may enable change, but leadership makes it stick.

Conclusion

Companies that embrace value-driven engagement, align commercial strategy with supply chain resilience, and integrate technology effectively will be the ones shaping the future of sales effectiveness. However, true success lies beyond just adopting new tools; it requires strong leadership, a cultural shift, and continuous upskilling of sales teams.